Project Brief

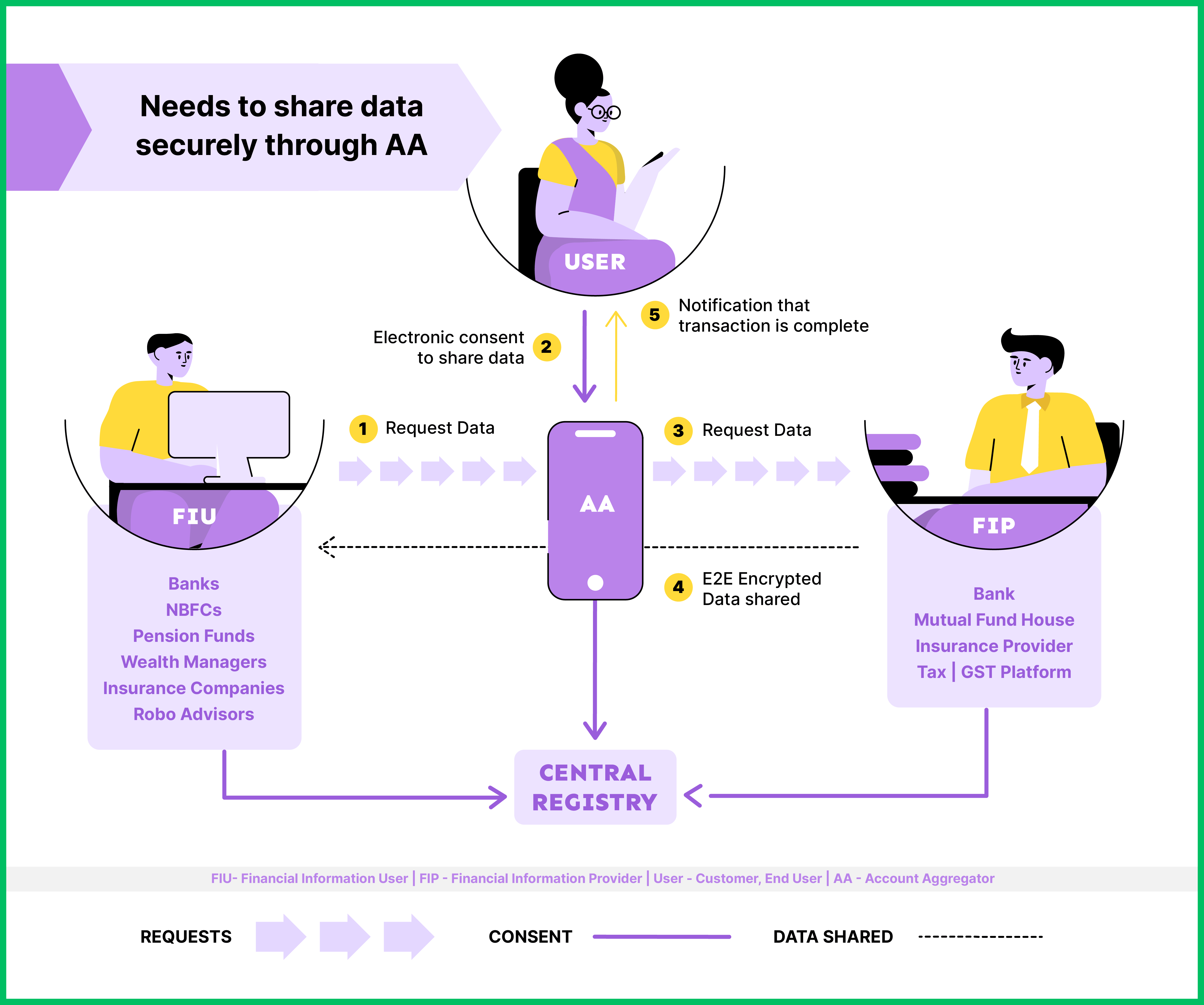

Our project aims to create a comprehensive Financial Data Access and Integration Platform. This platform will enable users to securely access their financial data with their consent, facilitating streamlined income verification, credit monitoring, and personal finance management. The platform will serve as an intermediary, facilitating secure data sharing between Financial Information Providers (FIPs) and Financial Information Users (FIUs).Account Aggregator (AA)

The core of the platform will be the Account Aggregator, which facilitates secure data sharing between FIPs and FIUs. Similar to a UPI (Unified Payments Interface) app for funds transfer, AAs will enable the transfer of financial data with user consent. AAs will act as trusted intermediaries, ensuring data privacy and security throughout the process.

Timeline: ~6 months

Duties: Design Lead, covering interaction design, product strategy, visual design, UX content In collaboration withproduct owner, technical architect, software developers, product analysts

Tools: Photoshop, Adobe XD, Figma , Figjam, Illustrator.

What Are Account Aggregators, and How Will They Change the Fintech Ecosystem?

Account Aggregators are about to hit the fintech industry like a tornado. Whether you're a fintech startup or a financial giant, it's imperative to learn the ins and outs of AAs now.

Remember how UPI completely changed how people send money? No more awkwardly splitting restaurant bills, or digging for exact change to pay off that friend who's been bugging you for months.

Account Aggregators (AAs) are about to do that for all other types of financial transactions in India!

Imagine sending your bank statements in a single click, rather than having to print and deliver them. Or small businesses being able to share their financial data and get a loan in minutes, not months. Or sharing valid financial documents without having to sign them 100 times and show 10 forms of ID.

Whether you're a fintech startup or a financial giant, it's imperative to learn the ins and outs of AAs before they transform the fintech industry.

Looking for a primer on what an Account Aggregator is? Or how your fintech company can use it? Or where it should fit into your fintech product? Or what DEPA, OCEN, and the rest of the AA jargon actually means?

Keep reading for an explanation of all Account Aggregator concepts in layman's terms, a clear understanding of the changing fintech landscape, and how to prepare your product infrastructure and internal capabilities to adapt to AAs.

What exactly is an Account Aggregator?

Account Aggregators share data securely between FIPs and FIUs. Financial Information Providers (FIPs): organisations that hold your financial data — e.g banks, insurance companies, mutual funds, pension funds, etc. Financial Information User (FIUs): organisations that consume financial data to provide consumer services — e.g. banks, lending agencies, insurance companies, personal wealth management companies, etc. An Account Aggregator will facilitate the process of consent, much like how a UPI app facilitates the transfer of funds from one bank account to another. AAs will be used to transfer financial data rather than funds.

"Today only 8% of Indian small businesses get credit from the banking system. Due to combination of factors like public sector banks having high NPAs, NBFCs having asset liability mismatch, the whole thing is gridlocked." – Nandan Nilekani

Project scope

- Detailed Account Aggregators Integration Study.

- UX Research & Testing.

- Wireframe, UI Screens, and Prototype Development.

- Android, iOS, and Web Design.

Challenge

In summary, account aggregators are poised to be game-changers in the realm of financial data sharing, opening up a world of possibilities. The consented data sharing enabled by AAs allows any third-party app to securely receive users' data, thus giving rise to a range of new use cases. AAs represent uncharted territory for financial services and their users. As a consent-based data-sharing system, user trust will literally make or break the AA framework, and users are more likely to trust when they understand what is being asked of them and why. Hence, our main challenge was twofold:1. Designing for user trust.

2. Designing for informed consent.

01: Understanding the Fictional Product and the Persona

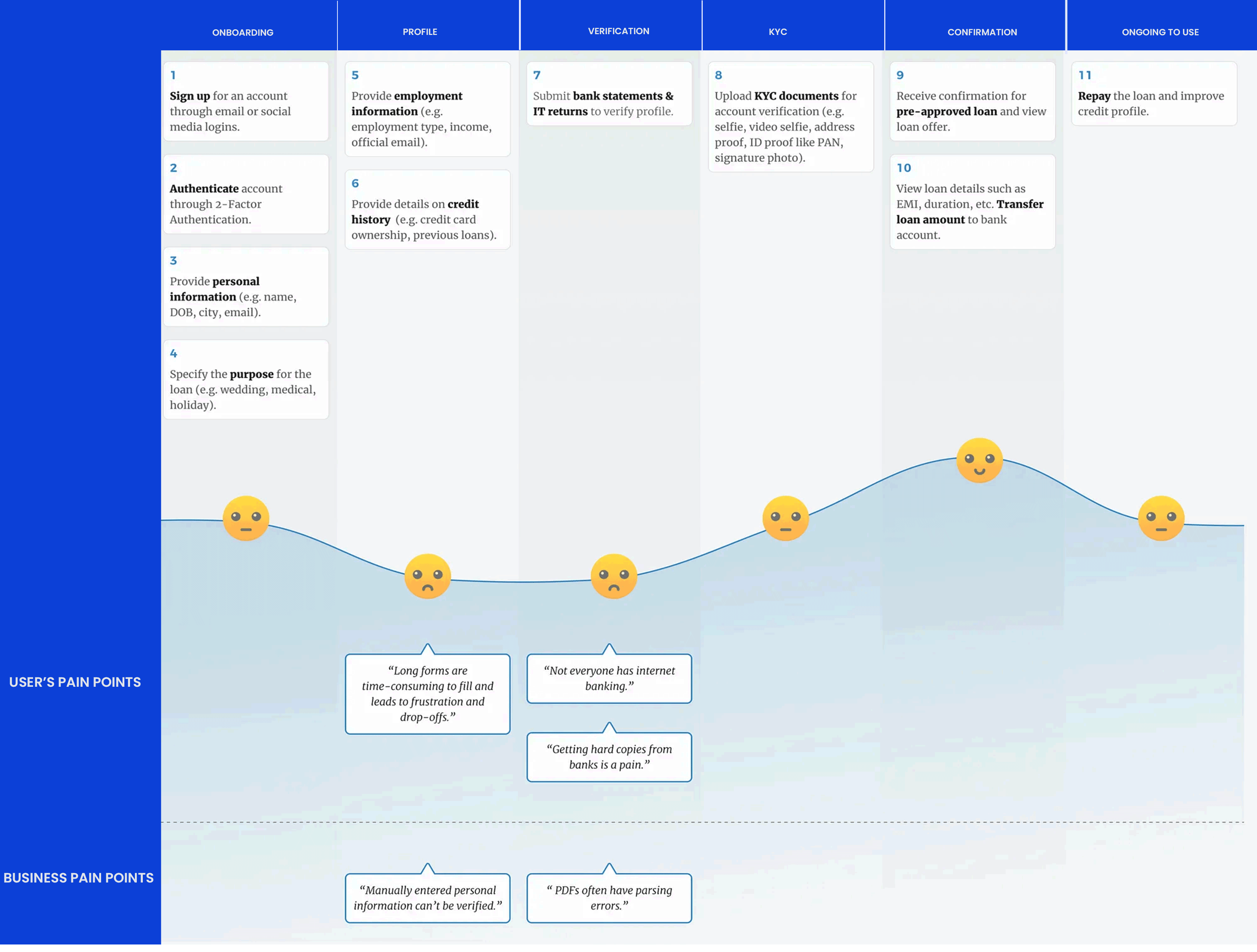

Our team's fictional product is Instamoney, which provides personal loans of up to 5 lakhs to users. We initiated the project by comprehending the existing application flow and identifying pain points for both users and the business:User Pain Points:

1. Lengthy forms that consume time and lead to frustration and drop-offs.

2. Limited access to internet banking for some users.

3. Cumbersome process for obtaining hard copies of documents from banks.

Business Pain Points:

1. Ineffectively verifying manually entered personal information.

2. Parsing errors often found in PDFs.

These pain points laid the groundwork for our design jam's goal: creating a new workflow for Instamoney by leveraging Account Aggregators to address the challenges faced by both users and the business.

Our objective is to design a new workflow for Instamoney that utilizes Account Aggregators to alleviate the pain points experienced by both users and the business.

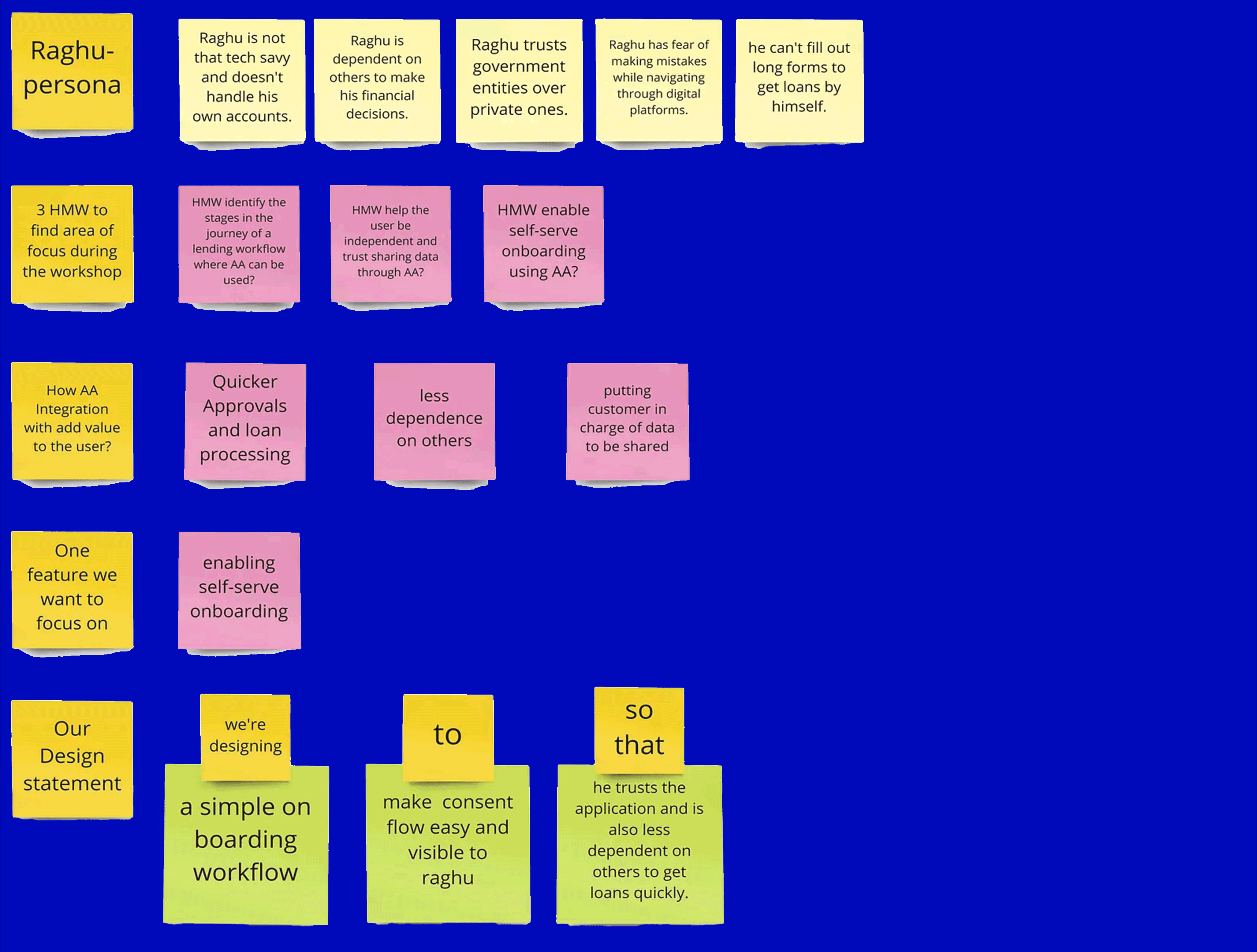

Who are we designing for? Our persona-Raghu

Before defining our core design challenge, we empathized with our persona, Raghu. The facilitators provided these personas to help us tailor our design challenge goal to their needs.

02: Building the Challenge Statement

To create a great design, one needs a clear objective. We began by generating 'How Might We' (HMW) questions related to our persona and the existing workflow of the Instamoney app. Additionally, we defined how integrating Account Aggregators (AAs) would benefit our persona. From there, we narrowed our focus to a single use case, which helped us formulate our refined design challenge statement:Our Refined Design Challenge Statement:

Design an onboarding process for personal lending that builds trust in the security of Account Aggregators (AAs) and educates users about the benefits of using AAs to share data, enabling them to independently access loans quickly and hassle-free.

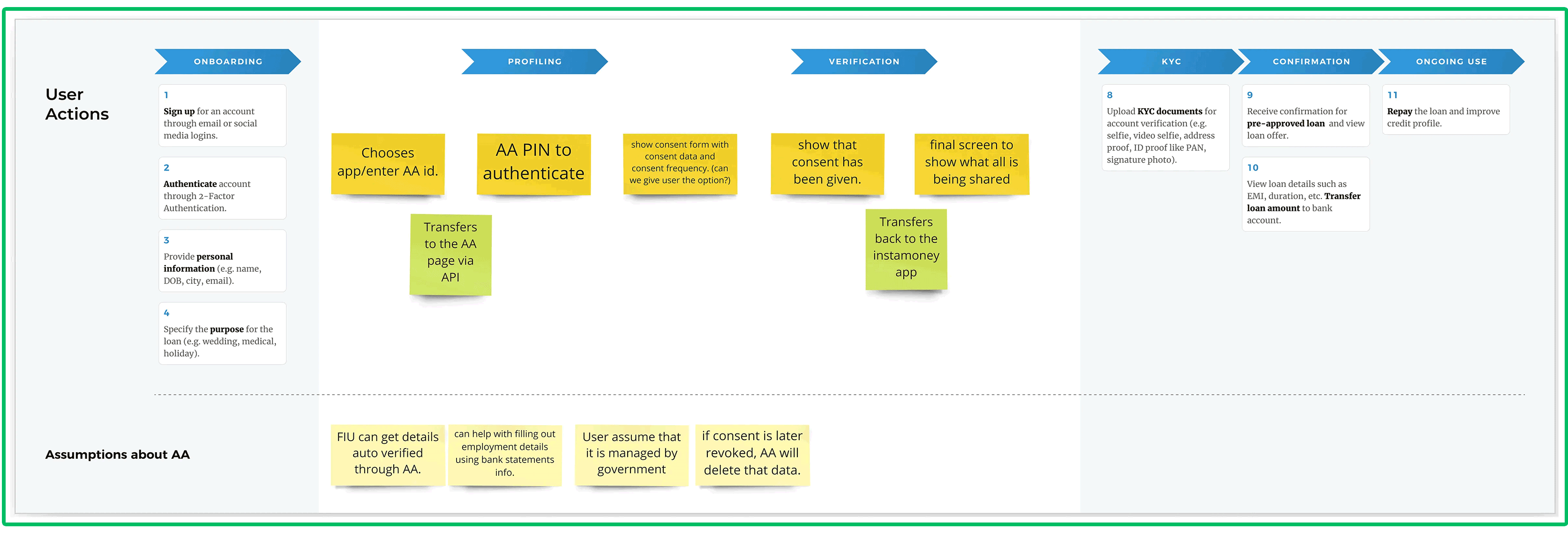

03: Mapping the new customer journey

In our pursuit to integrate an Account Aggregator (AA) based on the challenge statement, we embarked on identifying a sequential list of steps within the AA-integrated journey. Throughout this phase, numerous questions inundated our thoughts:1. Can KYC be seamlessly connected with AA?

2. To what extent can AA access the data?

3. What types of data can AA gather through Financial Information Providers (FIPs)?

4. Is there a potential for Financial Information Users (FIUs) to manipulate data retrieved from AA?

5. Will data collection occur even when the account is inactive?

Addressing these questions necessitated revisiting the resources related to Account Aggregators, aiming to gain a comprehensive understanding of their capabilities and limitations. This comprehension formed the cornerstone upon which our solution would rely. Clarity and certainty regarding the workings and concept of AA became our paramount objective.

Within our revised customer journey, our primary focus remained on alleviating the pain points identified earlier, facilitated by the incorporation of an Account Aggregator. Moreover, we meticulously examined the seamless integration of the AA flow with Instamoney.

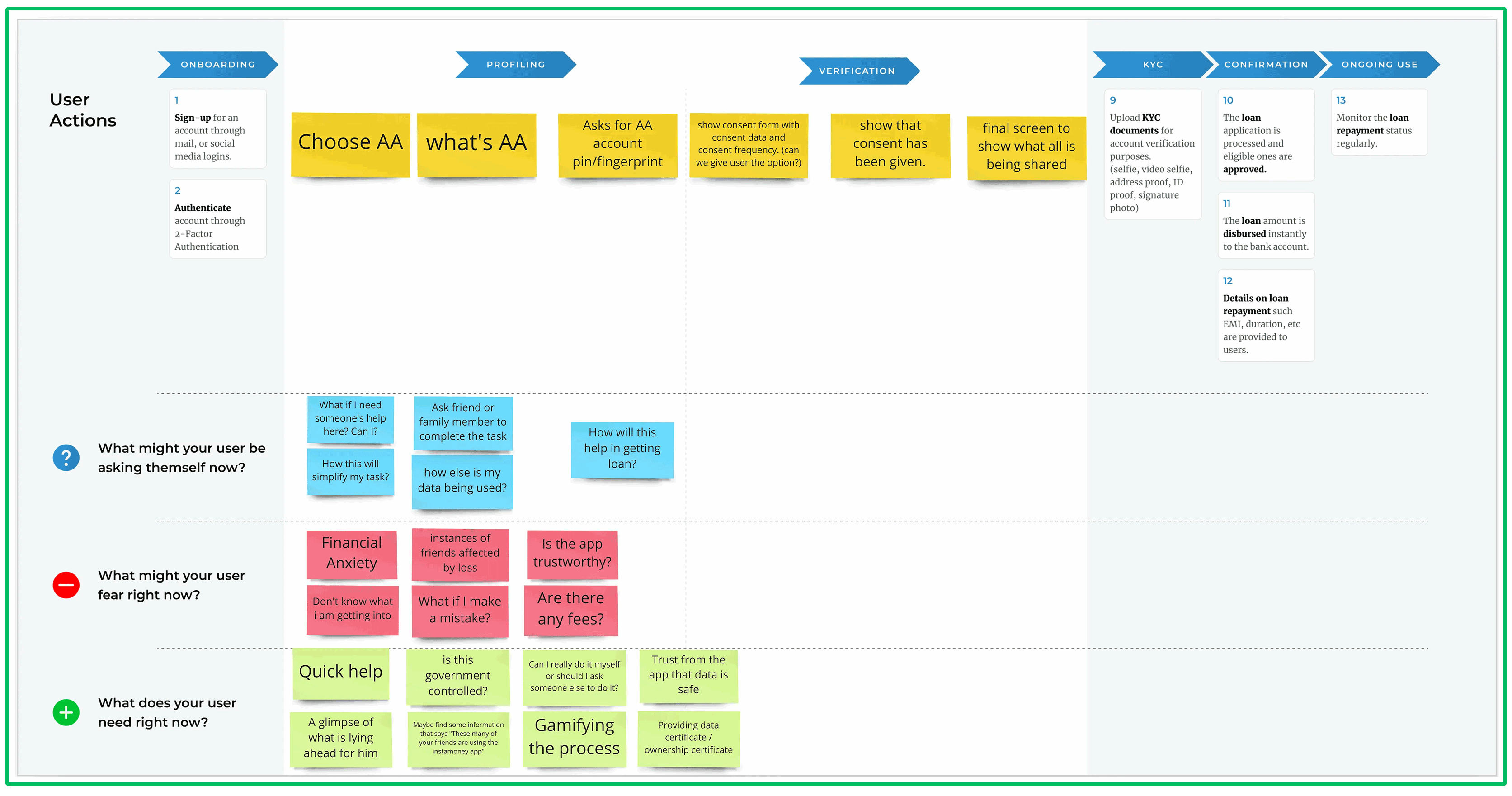

04: Discovering New Problems Through the New Customer Journey Map

We examined the new customer journey map from our persona's perspective, identifying their thoughts, needs, and concerns. This exercise deepened our empathy for our persona within the updated journey flow. The next phase involved understanding the newly identified flow challenges and brainstorming solutions specific to integrating the account aggregator.

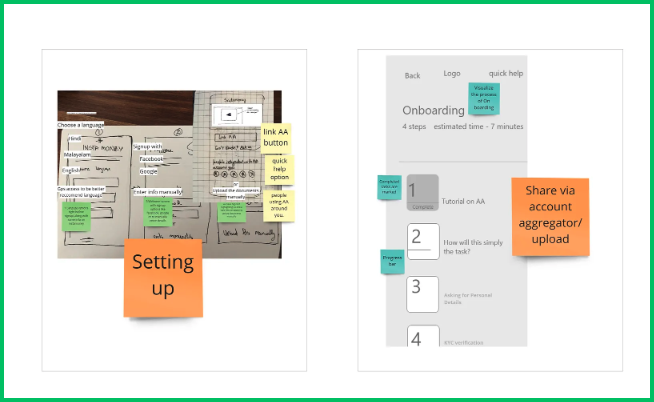

05: Sketching out different ideas

Our workflow can be divided into three major tasks:1. Educating Raghu about Account Aggregator

2. Building trust with sharing details via Account Aggregator

3. Giving Raghu a feel that his data has been safely shared with Instamoney with this consent.

We sketched out our ideas based on the above points:

06: Voting on ideas and creating the storyboard of the flow:

We used the heat map voting method to select ideas and discuss the ideas selected. These ideas were then put into the storyboard, a final flow of sketches which addresses our design challenge. This storyboard was our first reference point to see our new customer flow with our ideas into the visual form. While building the sketches into hi-fidelity form, we went through multiple iteration stages based on the feedback and review from our facilitator Parth and after Kishore’s mentoring session.Design principles for data sharing through Account Aggregator app

Usually, your financial information is spread across different banks and financial institutions. Each of these places, like your bank, insurance company, or mutual fund provider, is regulated by different authorities. When you need to move this information from one place to another, it involves a lot of steps like collecting data, making copies of documents, and sharing them manually. This happens every time you want to work with a new institution.To make this easier, the RBI introduced a new kind of financial institution called an Account Aggregator (AA). These AAs are licensed by the RBI and provide a digital platform to securely share your financial information among different Financial Information Providers (FIPs) and Financial Information Users (FIUs) with your permission. AAs act as middlemen between FIUs and FIPs and don't handle the data themselves. They can't see your data as it's encrypted and only accessible to the intended FIU. AAs don't store your data, reducing the risk of it being misused. Plus, your financial info can't be shared without your clear permission.

AAs' success depends on a user-friendly experience that's safe and easy to use. To help with this, D91 Labs created a UX playbook for sharing data through AAs as part of the Future of Data-Sharing project. This playbook has six design principles for those making data-sharing workflows using AAs. But why do we need these principles?

AAs face unique challenges in data sharing that depend on user trust. Users trust more when they understand what's happening and why. Respecting data protection means apps should help users understand their choices. We created these design principles to achieve two goals: designing for user trust and designing for informed consent.

We made this toolkit after doing research, talking to industry and policy experts, community design sessions, and usability testing. To take this further, we're introducing a sandbox for developers and UX designers. It helps them see how they can use AAs in their apps. These principles and the sandbox help you get your app's UX ready for AA integration.

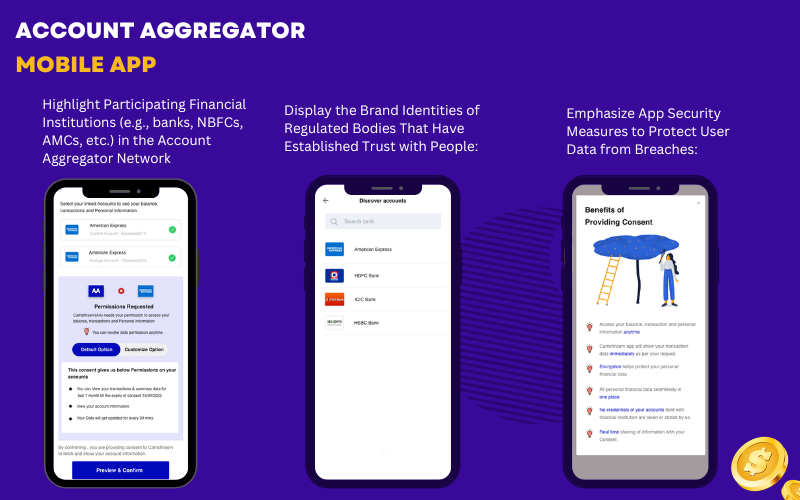

Design Principle—I

To establish authenticity and gain user trust, we must answer this question:How can we encourage users to trust account aggregators for data sharing?

Distinguishing between genuine and fake applications is increasingly challenging as time goes by. New internet users are vulnerable to scams that can lead to financial losses and identity theft. With the rising prevalence of online digital frauds and data breaches, users are naturally cautious about sharing information on new platforms, particularly when it involves financial transactions. Building trust involves crucial connections with licensing authorities and recognized banking institutions. This association helps reduce user skepticism and instills confidence in adopting the app.

UX Checklist:

1. Highlight the participation of financial institutions (e.g., banks, NBFCs, AMCs) in the account aggregator network.

2. Showcase the brand identities of regulated bodies that have a track record of earning people's trust.

3. Emphasize the security measures implemented by your app to safeguard user data against breaches.

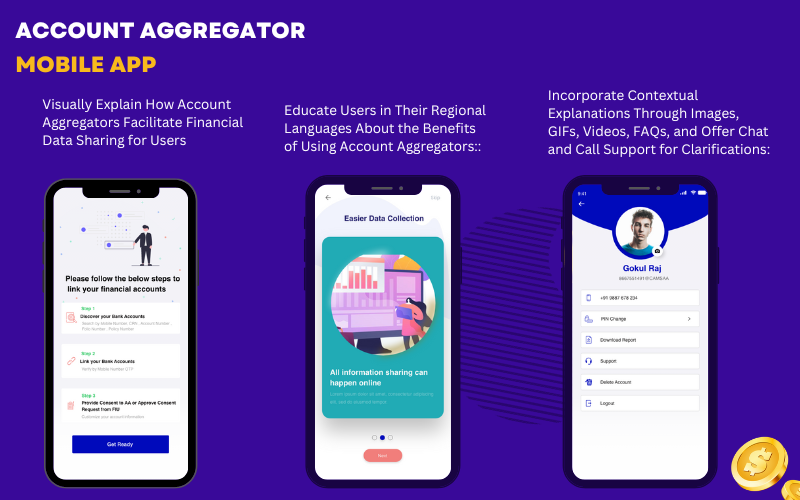

Design Principle—II

To encourage positive behavior change by providing essential information at the right time, we need to address the following question:How can we effectively inform users about account aggregators?

When people encounter account aggregators for the first time, they often experience fear of the unknown. They have questions and doubts at every step, which can hinder them from making informed choices. Since account aggregators are a new concept, the lack of understanding often leads users to resort to older, more familiar methods of data sharing. For instance, some users might opt to upload a PDF of a bank statement rather than using account aggregators. To address this, it's essential to educate users with a concise introduction to Account Aggregators (AAs) and how they work. Breaking down educational content into shorter, easily digestible snippets and presenting them contextually can reduce cognitive load. For users with low literacy levels, enhancing accessibility to the provided information by converting it into images, audio, or video formats is crucial.

UX Checklist:

1. Visually explain how Account Aggregators assist users in sharing their financial data.

2. Educate users about the benefits of using account aggregators in their regional languages.

3. Incorporate contextual explanations through images, gifs, videos, and offer support through chat and call services.

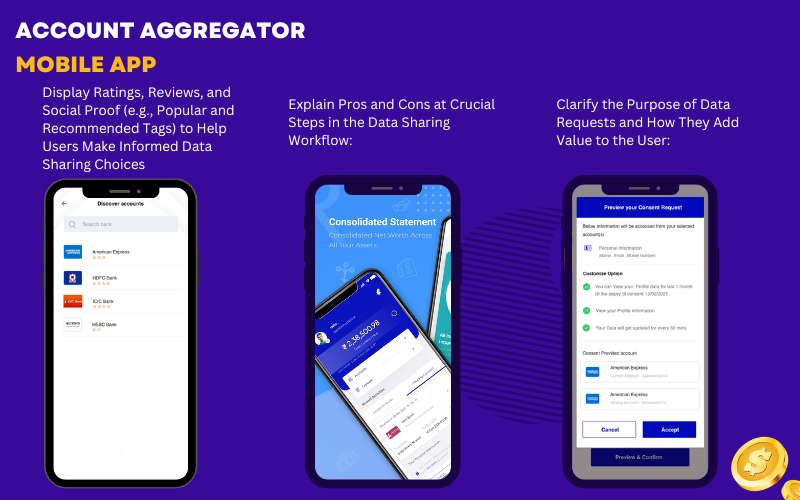

Design Principle—III

Nudge to make relevant choicesHow might we help the user in making relevant choices?

Sharing financial information through account aggregators demands a user make critical choices at various points. They face cognitive overload while deciding to choose the appropriate account aggregators, financial information, and relevant accounts to share. This results in decision paralysis as they fear that the cost of making a mistake could result in irreversible damage. Empower the users with relevant timely nudges that would ease their decision-making process and eliminate the fear of making a mistake. Break down larger activities into smaller tasks for the user to act upon without cognitive overload.

UX Checklist:

1. Surface ratings, reviews, and social proofs like ‘popular’ and ‘recommended’ tags to the user to make relevant choices while sharing the data.

2. Explain the pros and cons of making a choice at every crucial step of the data-sharing workflow.

3. Explain the purpose of the data requested and how it would add value to the user.

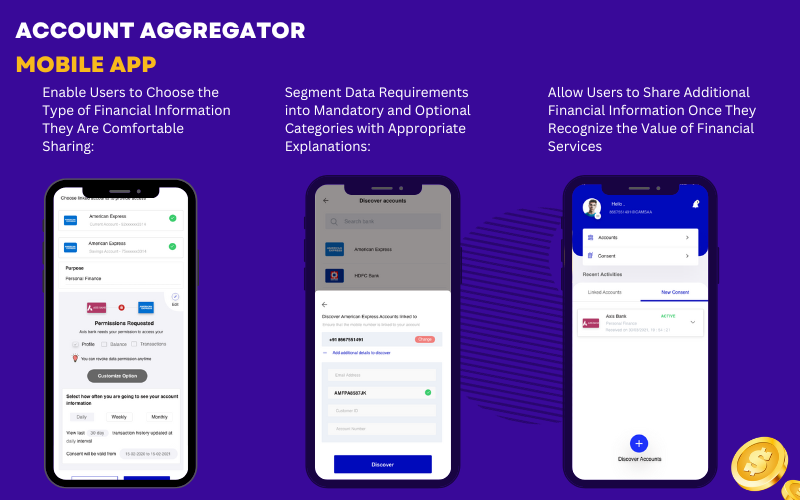

Design Principle—IV

Enable data sharing controlsHow might we enable the users with controls to share their data?

The ease of data sharing comes with the fear of being ripped off of their sensitive personal information without their permission. There are two kinds of fear that the users associate with. The first is the fear of over leveraging the data (i.e) sharing more data than required and the other one being data abuse (i.e) the fear of misusing the data for non-stated purposes. They might choose to discontinue their journey inside the app/service if they are refused appropriate control over what can be shared. Segregate your data requirement into mandatory and optional financial information. Educate the users about why optional financial information is required and how it would benefit the users. Allow the users to pick and choose the financial information they are willing to share.

UX Checklist:

1. Segregate the data requirements into mandatory and optional data with appropriate reasoning.

2. Enable the users to choose the kind of financial information that they are comfortable sharing.

3. Later allow users to share any additional financial information once they understand the value of the financial service.

Design Principle—V

Establish grievance redressal workflows.How might we support the users with their queries post data sharing?

Users fear the lack of accountability in digital applications when something faces issues. In an offline world, the users could walk into a bank branch or speak to an agent who helped with the service and could get their queries answered. Though most modern applications have a help desk and support they're not easily accessible during the need of the hour. Users' previous experience with poor customer service in banking services would affect how they view their current application. Surface customer care numbers and help desk chats at every possible touchpoint. Establish a human contact through service executives who could help the users with their queries. Create the support and help modules in native languages or through videos that could be accessible by the larger set of users.

UX Checklist:

1. Allow users to connect to a customer support representative with ease to resolve critical issues around data sharing.

2. Document the support and guides in regional languages for users unfamiliar with English to access them.

3. Highlight user actions that can be revoked/reversed later and provide an accessible guide for the same.

Design Principle—VI

Provide visual cuesHow might we boost the confidence of the user through appropriate feedback loops?

Data sharing with AAs involves multiple touchpoints such as the FIU, AA, FIP and the data that is being shared is largely invisible to the user's eyes. The fear of navigating these unknown spaces leaves the users in splits when they do not receive appropriate feedback for their actions, leaving them feeling anxious with second thoughts about their decision.

*Provide visual cues about the kind of financial information that is being pulled from the FIPs. Communicate reasons for errors and waiting time during the data sharing. Pinpoint the system responsible for the delay and further actionable that a user could perform to resolve it. Enable double confirmations at touchpoints where the user makes critical decisions. Notify the user every time whether the data being pulled is successful or not. *

UX Checklist:

1. Represent visually the data flowing from the FIPs to the FIUs for the user to gather confidence.

2. Communicate appropriate system errors and warnings for the users during long wait times.

3. Send real-time notification to users for every successful and failed data pull from the FIPs.

These design principles are customer-centric and intended to make the user journey hassle-free and safe. They also hold the potential to offer innovative financial products and services to existing and new-to-bank customers thus pushing the needle on financial inclusion.

High Fidelity Designs

Account Aggregator (AA) Prototype

User Testing :

User testing for an Account Aggregator (AA) app is essential to ensure that the app meets user needs, is user-friendly, and functions as intended

Solutions

- Clear Onboarding Process: Create a user-friendly onboarding process that explains the benefits and functionalities of the app. This should include easy steps to connect their financial accounts

- Educational Content: Provide users with educational content about how Account Aggregators work, the security measures in place, and the benefits of using them.

- Visual Data Presentation: Present financial data in a clear and visual manner, such as pie charts and graphs, to help users better understand their financial status.

- Customizable Alerts: Allow users to set up customizable alerts for specific financial transactions, account balances, or any suspicious activities.

- Multi-Language Support: Offer support for multiple languages to make the app accessible to a wider user base.

- Two-Factor Authentication (2FA): Implement robust security features like 2FA to ensure the safety of user data.

- Secure Data Storage: Ensure that user data is stored securely and encrypted to prevent unauthorized access

- Customer Support: Provide easy access to customer support via chat, email, or phone for any queries or concerns.

- Integration with Financial Institutions: Continuously work on expanding the network of financial institutions that users can connect to through the app.

- Consent Management: Implement a clear consent management system, allowing users to control which institutions can access their data and for what purposes.

- Compliance with Regulations: Stay up to date with financial regulations and ensure that the app complies with data privacy laws.

- Data Portability: Allow users to export their financial data from the app in a standardized format.

- Regular Security Audits: Conduct regular security audits and assessments to identify and address vulnerabilities.

- Feedback Mechanism: Include a feedback mechanism for users to report issues, provide suggestions, and share their experiences

- Partnerships: Collaborate with financial institutions to promote the use of Account Aggregators and make the integration process smoother

- User Education Campaigns: Run campaigns to educate users about the advantages of using Account Aggregators and dispel any misconceptions.

- Cross-Platform Accessibility: Ensure that the app is accessible on various platforms, including web, mobile, and desktop.

- Data Analytics: Use data analytics to provide users with insights into their financial behavior and suggest ways to improve their financial health.

Reviews

The reviews are good so far. There are still a lot of things to do.

- 👨💻 Downloads: 100000+

- 🏆 Reviews: 6.3M+

- 🌟 Rating: 4.3

Measure/Impact

Coming up with a solution isn't enough. We had to show its success with data/matrics. But as I mentioned earlier: To comply with my non-disclosure agreement, I have omitted and obfuscated confidential data/matrics in this case study. Here are some example metrics we used to measure the success of the redesign- Task completion rate — Percentage of the correctly completed task

- Task completion time — the time it takes for the user to complete a task

- Engagement — How often users are interacting

- Retention — Persuading the user to use again

- Revenue — Is the product making money?

Reflections & Take-aways

This project was different from the previous ones I had worked on, such as Mutual Funds. In my previous projects, the primary goal was to curate a mutual fund experience for distributors and investors. However, the purpose of this project was to create a feature that would address an existing problem.Given the problem-solving aspect of this project, I recognized the importance of understanding the problem from the users' perspective and thinking creatively beyond what is currently available in the market. To achieve this, I conducted thorough and in-depth interviews, brainstormed ideas during the ideation stage, and developed detailed wireframes. Understanding that participants had diverse concerns and approached their finances differently, I prepared a comprehensive set of questions to guide the interviews and explore the user's financial journey.

To stimulate innovative thinking and generate a multitude of ideas following the interview process, my mentor encouraged me to use "Crazy 8" exercises.

Fortunately, this project centered around the Account Aggregators app, which allowed me to easily assemble the graphic and UI elements. Therefore, the testing phase focused more on how I implemented the feature. As this was my first experience with a project of this nature, breaking it down into manageable steps helped me concentrate my efforts and integrate the various elements effectively.